Ushering in a new era of digital value transfer

This article is part of the “Capital Markets: Past, Present, and Future” Series.

The previous article presented a plethora of modern-day key technologies, capabilities and trends, impacting financial services firms in many varied ways — some obvious, but some esoteric to how the financial markets behave. This article talks about one technology driver which is arguably the most impactful for the capital markets, blockchain technology.

“What is the question for which blockchain is the answer? Trust.” — Edward Snowden, Nov 2018

What is Blockchain?

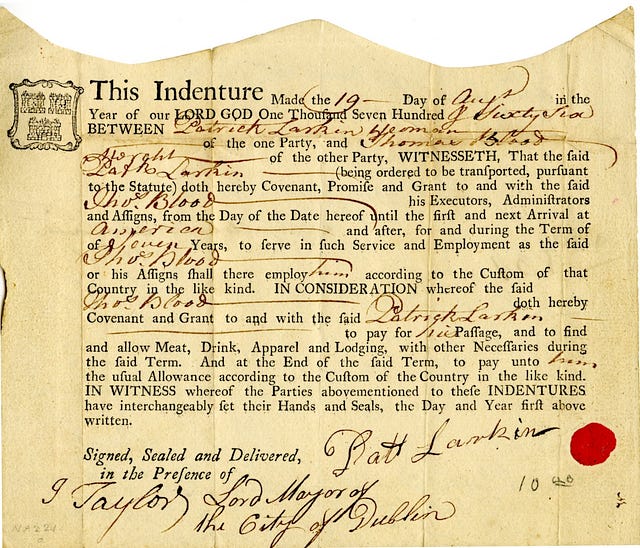

We live on the cusp of a significant digital transformation. Everyone has heard about the blockchain, the technology powering Bitcoin, which was originally developed by hackers and open-sourced. It is so powerful that within less than 10 years it is applied to the most demanding and complex financial sector. Despite the big noise around blockchain in the media, simply put it is a ground-breaking technology that for the first time in human history solved the big problem of how to create and maintain scarcity in digital assets. Two or more parties, without knowing each other, can forge agreements, transact, and build value without relying on middlemen to verify their identities, establish trust, or perform the operational side of the business (e.g. contracting, transferring value, record-keeping). With transactions having to be verified by a wide array of users (the “nodes”) as opposed to single trusted parties, transparency and security can be enhanced. The potential applications go beyond finance and have opened the way for contracts that exist on the blockchain and perform autonomous tasks to execute “trustless” business logic (hence called smart contracts). There are now countless implementations and permutations — for a deep dive in the taxonomy for blockchains, read here.

Why Does it Matter?

A secure and trusted database that does not have a single point of failure has immense potential implications for capital markets.

Disintermediation

From cross-border payments to real estate to bespoke investment solutions, virtually all transactional activities have a middleman that facilitates the respective process for a fee. With its cryptographic security, distributed transparency, and digital format, blockchain is able to disintermediate a significant portion of these processes and leading to a faster, more efficient, transparent, and correct market infrastructure. Among other examples are peer-to-peer lending and transacting. This massive released value goes towards cost savings in financial services firms and, most importantly, makes finance affordable and accessible to most investors. ResonanceX demonstrated this and the reductions in cost, time and risk at the world’s first structured investment on a blockchain in Q1 of 2018.

Tokenization of illiquid assets

This is another game changer. One is able to have secure ownership of an asset, either for themselves or shared with other people, with zero paperwork and completely verifiable. This matters in cases where the asset may be physical and transactions typically involve high execution costs. As I write this, I am only a stone’s throw away from the founder of RealBlocks (he was kind enough to lend me his umbrella yesterday) — they successfully apply blockchain in real estate in this exact fashion. Tokenization also enables fractional ownership (i.e. splitting a large deal into many smaller pieces), which makes assets previously reserved only for the ultra-rich or the large institutions, accessible to everyone by significantly lowering any barriers to entry.

A single golden source of truth

The number of inefficiencies, and potential for fraud as a result of bureaucracy and legacy infrastructure in industry and government cannot be underestimated. There is immense amounts of information on different databases (e.g. transaction data, trade information, records of ownership) generated at different parts of a process, different entities within an ecosystem or company, or at different periods or geographies. The impact of blockchain technology is the massive operational simplification and data transparency between many parties, e.g. elimination of out-of-sync ledgers, need for reconciliations, and no fragmented or hidden data that yield multiple versions of the truth. We have already seen supply chain management pilots, platforms for contract negotiation and management, as well as others enabling physical items to have proof of authenticity, existence, as well as ownership.

Decentralized identity

A far-reaching implication is decentralized identity. Just like blockchain can be used as secure custody of real or digital assets, the same can be applied to our actual unique identities. Put simply, our passports, birth certificates, ID cards, banking information etc. can be placed on the blockchain which can then serve as our proof-of-identity when accessing countries or establishing citizenship. When applied to finance, our digital identities can facilitate instant identification and anti-money-laundering verification, vastly improving customer experience but also reducing relevant risks when opening bank accounts, investing, etc.

One area in focus: Custody of digital assets

A proliferation of cryptography-based digital assets means that investors will be able to transact in a peer-to-peer fashion, but will still need to have these assets safeguarded from loss and theft. Such an important regulated function that applies to traditional finance (e.g. stocks, bonds) has to dematerialise for the digital world. The UK’s Regulator (Financial Conduct Authority) has already recognised that under the right conditions the blockchain can be seen as an independent third party — there is no need for a Registrar (a company maintaining a record of securities ownership). A custodian thus becomes the guardian of private keys, safeguarding the client’s digital assets. This simplifies security issuance as relevant documents are digitally issued and the transaction can happen in a purely peer-to-peer manner between the issuers and investors. All of this is managed with smart contracts, conditional to the necessary Know-Your-Client / Anti-Money-Laundering and appropriateness tests, fully automating this process.

A world’s first

It was in November 2017 when the world’s first cryptocurrency-denominated bond was issued, cleared, settled, and registered on an open public blockchain (Ethereum) — removing the need for registrars and nominees while meeting regulatory and legal requirements. ResonanceX ventured one step further by facilitating the world’s first Structured Product issuance on the open public Ethereum blockchain within the UK Financial Conduct Authority (FCA) Regulatory Sandbox. This real-life pilot demonstrated the simplified flow of assets and money, resulting in an improvement of the speed (from days to minutes) and cost structure of the issuance, clearing and settlement (large cost savings), as well as the enhanced compliance and accountability that transparency brings (ability to monitor asset and money on the blockchain). The significant reduction of operational risks through full automation should not be understated here too, as this is another of the main adoption drivers for this specific technology.

The Challenges

It is still early days with low scalability, lack of common standards, and a nascent legal environment

With all of its promises, blockchain and its respective markets are still very young and evolving rapidly. The regulatory framework is constantly adapting to the developments across the globe while central banks and large financial institutions are closely examining or testing how blockchain technologies will benefit or affect their business. Only recently, the UK Law Commission launched a research project to ensure that the law is sufficiently certain and flexible to apply in a global, digital context and to highlight any topics which lack clarity or certainty — regulators and lawmakers are addressing such uncertainties to stay competitive in this truly global landscape for goods, investments, and services.

It is widely accepted that the biggest public blockchains in their current state do not scale. The time taken to include the next block in the blockchain (block delay time) and the number of transactions at any time (throughput) are still not on par with the needs of most industries. As a response, large-scale projects are working on blockchain features that will overcome such hurdles, with the more prominent ones being Lighting for Bitcoin and Sharding for Ethereum. In the private blockchain space, there are a number of projects aiming at enterprise solutions that are addressing such issues or targeting specific capital markets verticals. At the same time, due to the still high volatility of even the most liquid cryptocurrencies, it is hard to justify capital raises denominated in any cryptocurrency.

One of the biggest barriers to adoption is this technology’s user interface — it still too hard for the average person to take advantage of this technology. When buying, selling, and earning in cryptocurrency significantly improves, we will see tremendous inflows into the ecosystem. While we are still far from addressing all these issues, the monumental influx of developers, capital, and skilled financial services professionals in developing the ecosystem in 2017 and 2018 send a strong signal as to its bright future.

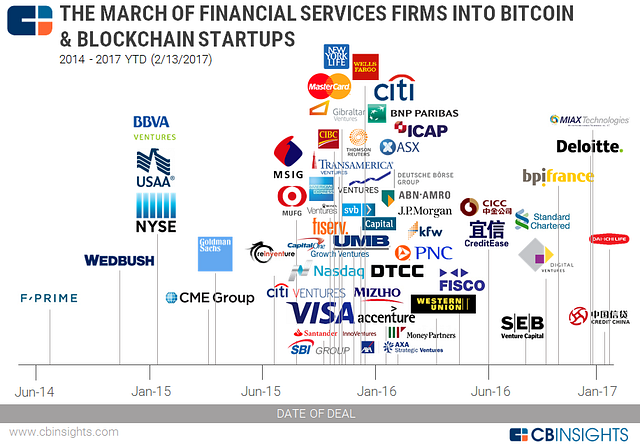

The Big Players Are Positioning

Investment banks, asset managers, & exchanges’ recent moves to deploy this technology in capital markets stir up new competition

The digital asset space presents an unprecedented opportunity for capital markets and the economy in general. The direction of the financial industry is clear. In 2018, we saw many announcements from large institutions and banks in relation to tokenized securities, or consortia initiatives that will drive adoption. Here are some of the most prominent announcements:

– The London Stock Exchange will participate in a test trade for the primary issuance of tokenized equity to institutional investors within the UK FCA’s Regulatory Sandbox

– The Canadian Securities Exchange will be the first blockchain-powered exchange in N. America

– The Depository Trust & Clearing Corporation (DTCC), which lies in the heart of the global financial services industry, is working with IBM, Axoni, and R3 to provide a distributed ledger technology (DLT) to drive efficiencies in derivatives post-trade lifecycle events.

– SIX Stock Exchange in Switzerland announced in July that they will be launching a platform to tokenize and trade traditional securities

– The Intercontinental Exchange (ICE), which owns the New York Stock Exchange, will soon offer a regulated market for Bitcoin, turning it to a trusted global currency with broad usage for institutions.

– Austria announced its issuance of $1.35 billion in government bonds on the Ethereum blockchain, and the World Bank launched the world’s first public bond on the blockchain

– The Japanese Banking Association has been conducting trials with Fujitsu on an interbank funds transfer settlement system for small-scale transactions

– Fidelity, one of the largest asset managers, launched a separate company called Fidelity Digital Asset Services specifically for the custody, trade execution, and institutional exposure of cryptocurrencies.

– The top three holders of blockchain-related patents come from Bank of America, Mastercard, and Fidelity.

– The World Economic Forum published a report identifying 65 different applications of blockchain technology that can alleviate some of the most pressing environmental dangers facing life on earth

– One state in the USA (Ohio) even became the trailblazer in starting to receive Bitcoin for its tax bills from December 2018, showing strong support for the emerging digital currencies space

The above instances are evidence of traditional firms venturing into the digital space. But the opposite should not stand as a surprise. One such example is a cryptocurrency mining firm raising £25 Million through a Initial Public Offering in the London Stock Exchange in August 2018.

Summary

The potential of blockchain technology is not to be understated and is further validated by the substantial amount of capital coming from traditional venture capital, topped off with a strong influx of developer talent and project progress. It is worth keeping in perspective that this technology is still in its infancy and being continuously improved. Just consider the internet, it started with defence funding in the 1960’s and served to connect research institutions and universities. Its “killer app” was the open protocol that allowed for the email (in the 1980’s), which drove the internet’s adoption, and the rest is a history of compounding innovation.

It is thus impossible at this stage to foresee with certainty the when and the extent of how blockchain technologies will affect financial services or the financial system as a whole. This technology is not just disruptive, but foundational. And don’t just take my word for it — Harvard is always a good place for second opinions.

We will see significant changes in the industry, with financial services firms benefiting from blockchain technology in their operations, allowing agile firms to broaden their reach, serve their customers better, and innovate much faster than what was possible in the past. This evolution will exist at the precipice of competitive pressures Andreesen Horowitz describes so succinctly:

“The battle between every startup and incumbent comes down to whether the startup gets distribution before the incumbent gets innovation.”

While blockchain is the table-stakes technology of the future, the verdict remains as to how and who will capitalize the most.

Next article will focus on the convergence of the various technologies currently being applied in capital markets. With the increasing proliferation of blockchain infrastructure combined with other technologies such as artificial intelligence, the markets of the future are poised to look very different than today. Stay tuned!

In this series of articles, I cover the current challenges, the applicable technologies, and how some Fintech companies are harnessing the inevitable tides of change. Please share your comments and feedback as I explore these topics — from seasoned professionals, to technologists, to the eternally curious!

The author, Hariton Korizis, is the co-founder of ResonanceX along with Guillaume Chatain. The company is participating in the Barclays Techstars NYC Accelerator, the Kickstart Accelerator in Zurich, the UK Investment Association’s Velocity Accelerator in London, and is regulated by the UK’s Financial Conduct Authority. In March 2018 the world’s first Structured Product to be cleared and settled on the open public Ethereum blockchain was issued through the ResonanceX platform. The transaction was automated end-to-end, and fully compliant with existing laws and regulations, setting the foundation for how Structured Products can be traded from now into the future.